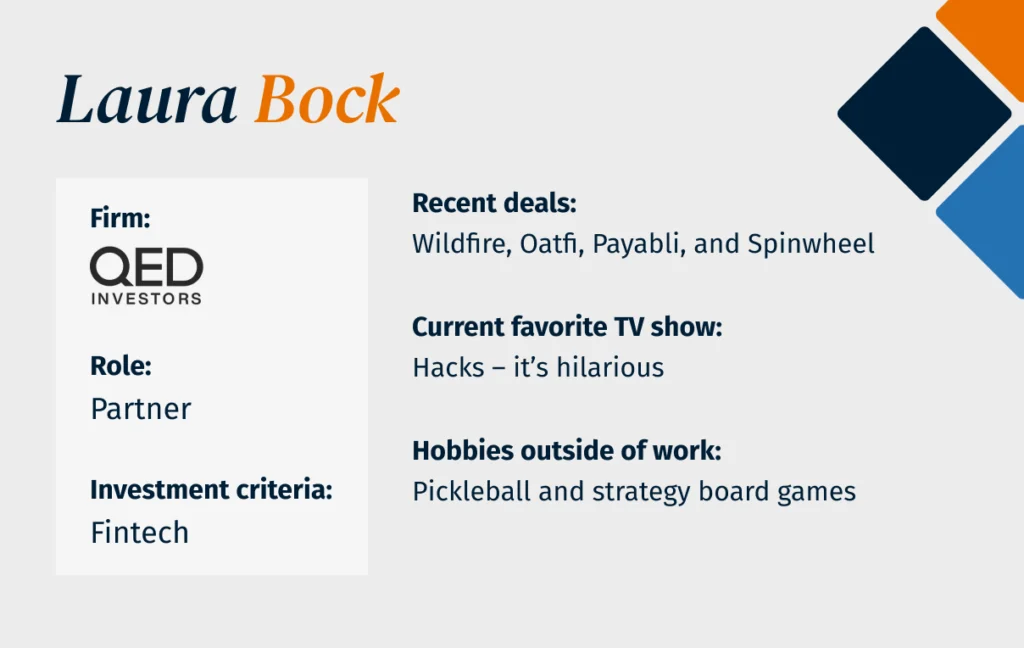

Builders & Buyers: Laura Bock of QED Investors on Fintech Evolution and Investment Insights

Venture Banking

Builders & Buyers is dedicated to showcasing leading figures in the fintech industry and their contributions. Through candid and in-depth conversations, Stifel Bank’s Managing Directors, Josh Dorsey and Jake Moseley, aim to connect audiences with the thought leaders driving the future of finance. The series will explore personal journeys, company building, investing strategies, and topical macroeconomic conditions.

Notes from Josh Dorsey, conversation moderator:

Laura Bock is a dynamic individual, incredible human, and partner at QED Investors. She focuses on U.S. fintech investments and is a rising star in the industry. Throughout our conversation, I was impressed by her undeniable determination and focus paired with a calm kindness that makes you feel welcome and comfortable. In the interview, Laura provides investment themes, how fintech has evolved, and future opportunities—plus insights into her personal journey. Enjoy the fun conversation I had with Laura Bock.

Josh: Let’s start with some basics to help people get to know you. Where did you grow up, and where are you now?

Laura: I grew up in Medfield, Massachusetts. I went to Princeton for college and moved to New York 12 years ago after graduating.

And what’s a fun fact about yourself?

I have a dog Rafa who is obsessed with tennis balls, which is fitting given he’s named after my favorite tennis player.

Any book recommendations?

I recently enjoyed Seveneves by Neal Stephenson, a science fiction novel.

Moving into fintech, let’s talk about the biggest changes in the sector over the last decade. You’ve been investing since 2017. What have you observed?

QED has been focused on the fintech space since the firm was founded in 2007, so we’ve seen several phases. Initially, there were waves of new businesses enabled by mobile and cloud technologies. Monoline players unbundled the bank, and now there’s been a rebundling. The rise of generative AI is also a significant change, although its full impact is still uncertain.

Net net, the biggest change has been, and will continue to be, in its scale: the fintech ecosystem has expanded dramatically over the years and it continues to grow. The global financial services industry generates $12.5 trillion in annual revenues and is 20% of GDP in the US, but fintech is still in the early innings. QED recently released a global fintech report, co-authored with Boston Consulting Group, that found that fintech is expected to reach a market size of $1.5 trillion in revenue by 2030, which is about five times from today. From an investor perspective, we’ve seen the number of companies, founders, and investors grow substantially, creating a much larger and more exciting space. The infrastructure market has also matured, making it easier and less costly to launch financial services products.

We’ve also seen a cycle in the funding environment, with highs during COVID and a downturn starting in early 2022, followed by stabilization—almost taking the shape of an EKG chart. After a run-up in the preceding several years, the amount of capital deployed into fintech has significantly decreased from 2021/Q1 2022 highs returning to pre-2020 levels. This shift has impacted how we advise companies on thinking about the cost and availability of equity dollars, managing their capital, and balancing efficiency with growth. Some startups that have proven their model are turning growth mode back on, and the market has remained very supportive of breakout companies.

“After a run-up in the preceding several years, the amount of capital deployed into fintech has significantly decreased from 2021/Q1 2022 highs returning to pre-2020 levels. This shift has impacted how we advise companies on thinking about the cost and availability of equity dollars, managing their capital, and balancing efficiency with growth.”

What about trends impacting fintech?

We are tracking a number of macro trends that may shape the future of finance services:

- Rise in the aging population: People over the age of 65 are the world’s fastest-growing age group. This massive demographic shift is causing a number of sub-trends, including rising costs of healthcare and staffing shortages, growth in travel, and the Great Wealth Transfer that will see around $70T in assets move from Boomers to their children, etc.

- Financial nihilism: Driven by increased living costs and decreased affordability caused by inflation and a housing shortage, people feel their financial goals are increasingly out of reach. We’ve seen a huge rise in gambling and day trading as a result. People need better financial tools to cope in ways that will set them up for success.

- Globalization / deglobalization: It is widely understood that the global economy has become increasingly interconnected, especially over the last several decades. While there may be a slowing of this trend, there is still room for the financial infrastructure to catch up (financial supply chain management, cross-border payments, trade credit) in support of more seamless global trade.

- Instant money movement: This has already taken off in other geographies (e.g., Pix in Brazil, UPI in India), and despite slow adoption, RTP / FedNow in the US will someday make waiting four days for money to flow via ACH rails—and all the associated issues—a thing of the past.

- Generative AI: When we think about the impact of Generative AI, banking and insurance consistently rank #1 and #2 in terms of its ability to transform work. Banking and insurance both have around 50% of working hours rated as having a high potential for automation and another 10% as having a high potential for augmentation. It’s not a question of if—it’s when and how generative AI will make financial institution workforces more efficient.

Given the current macro conditions, including inflation and rising interest rates, how is this affecting your approach and the sectors you focus on?

We’re fortunate to have launched new funds recently, which positions us well for future opportunities. While there’s been a pullback, especially in the growth sector, we’re actively looking for investment opportunities and have been deploying on pace. Of the $925M QED raised, $650 million is allocated to our early-stage fund and $275 million to the growth fund.

As a firm, we are laser-focused on how to find new and support existing portfolio companies. We see some recovery in the early stage market, although it has not been uniform depending on the sector—for example, certain proptech and lending vs. software/payments. Businesses sensitive to inflation and rising interest rates have had to adjust their plans, while many businesses have seen tailwinds in the current environment based on customer interest and increased availability of talent.

What areas within fintech are you most excited about?

We are big believers in embedded finance. In fact, QED recently published a report with BCG that uncovered that, by 2030, embedded finance will account for $320 billion in revenues worldwide. We’ve built a strong portfolio in this space, with companies that enable partners to quickly launch industry-leading products in banking, payments, credit, investing, insurance, shopping and rewards, and debt management. We see financial services being delivered more contextually within the platforms that consumers and businesses use day-to-day.

We are very excited about new advances in payments infrastructure as well. About 10-15 years ago, companies like Stripe and Adyen captured the market opportunity created by the e-commerce boom and have created $65B and $37B market cap companies, respectively. Today, we believe software-led distribution in payment infrastructure is opening the door for similarly massive businesses to be built. We are seeing a tectonic shift of trillions of dollars in payment processing volume migrating from legacy technology and traditional distribution channels to becoming embedded within software platforms. Even capturing a small portion of this market could lead to the next big fintech company.

Wealth management is another area we’re exploring. The traditional model of in-person meetings, static financial plans, one percent of AUM fee structures, and 60/40 stock bond rules of thumb won’t appeal to Millennials and GenX, who are the beneficiaries of the Great Wealth Transfer. We see a future where real-time, digital-first financial planning and advice becomes democratized and delivered more efficiently through technology.

As banking nerds, we’re very interested in core banking tech and the banking workforce. I recently read somewhere that nearly half of the US banking systems are built on a coding language—COBOL—that predates the Beatles. So, it’s safe to say that these systems are outdated. You can’t talk to an exec at an FI without them pointing to the limitation of their legacy tech stack. There is a big opportunity to innovate, though switching costs are prohibitive and many CTOs have tried and failed to migrate. Mortgage, loan origination, loan management, and other systems are all ripe for disruption.

“We are seeing a tectonic shift of trillions of dollars in payment processing volume migrating from legacy technology and traditional distribution channels to becoming embedded within software platforms. Even capturing a small portion of this market could lead to the next big fintech company.”

Let’s switch gears a bit and talk about your personal journey now. You have an interesting academic background in integrated sciences. How does that translate into your investing work?

Integrated Science was a program at Princeton that blended math and computer science with the sciences. Initially, I thought I’d go to grad school and take a more academic route, but I realized that I hated lab work. So, I switched gears and started my career in strategy consulting. Both consulting and sciences taught me to take a hypothesis-driven approach, and I think this applies well to investing. You start with a set of hypotheses which, if they are true, mean that you believe a company is a good investment opportunity. Then, during diligence, you peel back layers to test them. Similarly, at QED, we talk a lot about proof and anti-proof in early-stage company building. VC-backed startups consume capital for a number of years to run experiments, and through this process can see signals that things are working (proof) or not (anti-proof). Great CEOs can be dispassionate in assessing these signals and then iterate quickly in the right direction.

It’s been an impressive journey so far. What’s the biggest lesson you’ve learned from your rapid ascent in the fintech world?

Timing was crucial for me. As QED’s first principal, I had a lot of exposure and autonomy early on. QED’s growth provided opportunities to learn by doing. Being part of a fast-growing organization means you often have to take on responsibilities you might not feel fully prepared for, but that’s where you learn the most.

Beyond the interview:

Here are links to where you can get to know Laura better.

Written by

Related Insights

Other articles designed to help you along your financial journey.