Four Years In: Trends and Takeaways on SoCal Venture

Venture Banking

Greg Singer (Senior Vice President) has spent the past four years in Southern California’s startup ecosystem. In this piece, he shares firsthand observations on venture momentum and how Stifel Venture Banking has supported founders, investors, and the broader community.

I’ve spent nearly a decade in the California tech ecosystem, beginning my career in San Francisco in 2016, where I spent six years working in and around Silicon Valley. In 2021, during COVID, I relocated to Los Angeles to explore what it meant to support companies outside the Bay Area. Since then, I’ve had the opportunity to reflect on how the Southern California market has evolved and to closely follow the companies, investors, and industry trends shaping the region. I’m by no means an expert and still have plenty to learn, but I wanted to share some thoughts and observations since making the move south.

It’s no surprise that when I first arrived in 2021, the tech and venture ecosystem was booming, with venture investments hitting all-time highs nationwide. Southern California experienced that same momentum, with strong activity across nearly every sector. From gaming studios and consumer brands to rocket and robotics companies, a wide range of startups were attracting sizable venture capital investments from both local and out-of-market firms.

As I was getting my footing in Southern California, what stood out early was how welcoming founders, investors, and operators were to a newcomer. People were generous with their time, offered thoughtful advice, and were committed to growing the region together. That openness made supporting companies, investors, and other key players in the ecosystem especially rewarding.

Now, after more than four years working in this market, much of what I’ve observed on the ground is showing up in the PitchBook data. Southern California is a dynamic and complex tech ecosystem, and I’ve done my best to distill my thoughts and observations over the years into why I love this region and why I’m excited for what’s ahead. With the help of some data, now feels like the right time to share these reflections and see if others feel the same. The data below covers 2020 through Q1’25 across all industries except life sciences.

Please note: there’s been an uptick in venture activity in Q2’25 and Q3’25, which is not reflected here. I’ll discuss year-to-date 2025 momentum more later in this piece.

A Closer Look at Southern California

Los Angeles has steadily carved out its place in national venture rankings. Depending on the metrics and industries included, it typically ranks 3rd or 4th nationwide in total venture capital investment. In 2024, it was among the top four U.S. markets, trailing only San Francisco, New York, and Boston. But the momentum isn’t limited to Los Angeles – venture activity is also strong in Orange County and San Diego, with more firms and companies establishing a presence across the broader Southern California region. That said, I haven’t seen many data sets that look at Southern California holistically, and I’ve spent the time to aggregate the data as best I can.

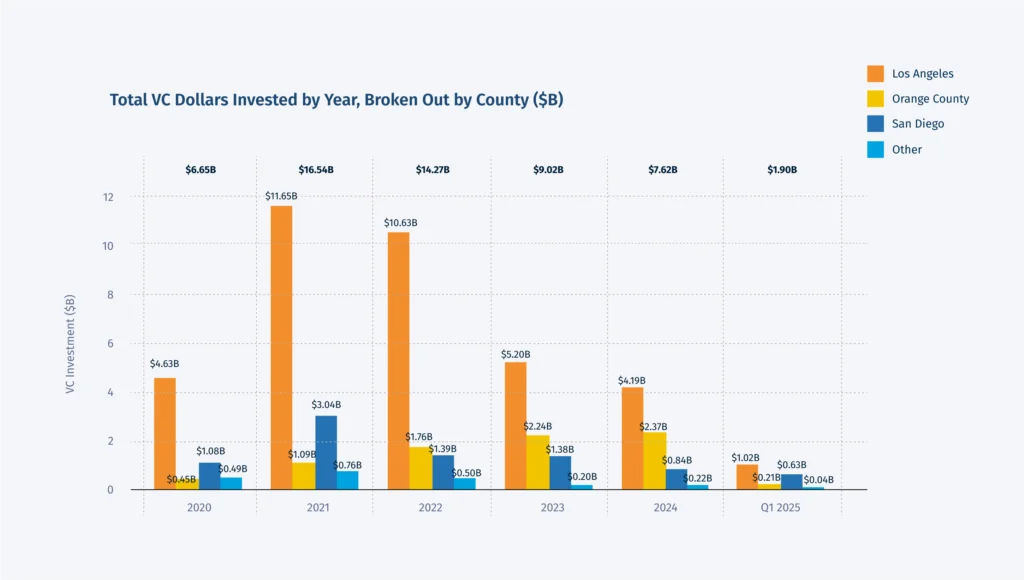

The graph above shows a downward trend in total dollars invested in Southern California from 2021 to 2024, according to PitchBook data. At first glance, that might seem like a red flag (cue dramatic music). But context matters: while total U.S. venture investment in 2024 was up compared to 2023, much of that growth was driven by a handful of Artificial Intelligence (AI) mega funding rounds, think OpenAI, Anthropic, Perplexity, and others, concentrated in Northern California and New York regions. Southern California, like many other regions that didn’t capture those outsized AI deals in 2024, followed a similar trajectory.

Looking ahead, there’s reason for optimism. According to Pitchbook, year-to-date 2025 venture activity in Southern California is trending positively and currently sits at about $9 billion in total venture investments, which is already ahead of 2024 levels. If this pace continues, 2025 is poised for strong year-over-year growth compared to 2024 levels.

Southern California Counties – Geographical Trends

To better understand venture trends in Southern California, it helps to break the region down by county. I’ve broken down Southern California into three key counties: Los Angeles County, Orange County, and San Diego County. Since 2020, Los Angeles has consistently led the way, accounting for roughly 66% of total venture dollars invested. Orange County and San Diego County each represent about 15% of the total.

This distribution isn’t surprising; Los Angeles County is the most populous county in the U.S., with more residents than San Diego County and Orange County combined. When you dig into the data by industry vertical since 2020, LA shows strength across the board, with particularly high concentrations in Consumer and Fintech, which each attracted over 80% of all dollars invested in those categories. Part of this concentration can be attributed to LA’s strong media and entertainment history and the web3 boom during early COVID. Enterprise and Hard Tech also performed well, accounting for approximately 63% and 57% of total investment, respectively.

Orange County’s standout vertical was Hard Tech, which made up 25% of its total venture investment. San Diego County’s strongest showing was in Enterprise, representing 28% of its total venture dollars since 2020.

Of course, every venture market has its outliers with companies that raise significantly larger rounds than their peers. In Southern California, several names stand out: SpaceX (LA), Anduril (OC), ServiceTitan (LA), ClickUp (SD), Shield AI (SD), and others have all secured major funding rounds since 2020, helping to shape the region’s investment landscape.

The Talent Flywheel: How Founders and VCs are Doubling Down on Southern California

Since moving to Southern California, I’ve been lucky enough to engage with many key players across different industries. Former employees of successful tech companies establish roots in Southern California (buy homes, start families, etc.). Those with the entrepreneurial spirit go on to start companies in their own backyard.

As more and more generations of successful tech companies spin out top-tier talent, the more the startup ecosystem flourishes. This dynamic is a key driver of industry concentration in certain counties, e.g., strong Hard Tech fundings in Los Angeles due to former SpaceX employees starting new businesses.

To fund these businesses, VC firms are a key piece of the puzzle. A decade ago, the VC firms that planted their flag in Southern California were much smaller than they are today. The data on this is difficult to dig up, but I estimated fewer than 50 active VC firms in Southern California in 2015. That number has grown to 150+ today. Many of these firms are focused on early-stage companies, but a growing number are raising larger funds to support start-ups as they scale. If you are a founder, you don’t necessarily need to make the hour flight to San Francisco to meet an investor in person. Instead, you can sit in traffic for an hour.

Industry Highlight: Hard Tech’s Growing Momentum

Hard tech continues to gain momentum in Southern California. Many of these companies build physical products and require significant capital to bring their ideas to life. This is reflected in the data: since 2020, Hard Tech businesses have attracted the most venture dollars in Southern California. In 2023 and 2024, Hard Tech venture investments were larger than all the other sectors combined.

The dollar size of venture rounds raised by hard tech companies is often larger than in other sectors due to their high capital expenditure needs. For example, the median deal size for hard tech companies in 2024 is approximately twice that of companies in the Consumer, Enterprise, and Fintech verticals—$9.8 million versus $5.3 million—based on available Pitchbook data.

I’ve also noticed a particularly high rate of talent spin-offs from successful Hard Tech companies, with employees going on to start new ventures. I came across a resource tracking SpaceX alumni who have founded their own companies: over 100 businesses have been started by former SpaceX employees, with about 50% of them headquartered in Southern California. Collectively, these companies have raised more than $6 billion in venture capital. Anduril is another good example of this. As part of this trend, many of these companies plant their flag in areas that can support larger offices and scaling manufacturing needs. El Segundo (“The Gundo”), Torrance, Hawthorne, and Long Beach are a few areas where we see a lot of Hard Tech companies securing office space.

What’s Next?

With year-to-date venture investment trending positively in 2025, I’m hopeful this momentum will carry into 2026 and beyond. Hard Tech continues to show strong potential, especially as many companies are still in the early stages of their lifecycle. These businesses will require significant capital to bring their products to market, and I expect this vertical to remain a key focus for Southern California.

While Enterprise, Consumer, and Fintech haven’t attracted as much investment in recent years, I believe AI will be a powerful catalyst for growth, unlock new opportunities, and expand investor interest across these sectors. I can’t predict the future, but AI is a transformative technology that will give rise to new businesses and categories we haven’t even imagined yet.

What We’ve Been Building at Stifel Bank

Stifel Venture Banking has taken a long view on what it means to support the innovation economy in Southern California. Over the past two years, our team has hosted or supported 90+ events across the region, helping founders, investors, and operators connect and collaborate.

Beyond that, we’ve supported companies throughout their lifecycle, from pre-seed to late stage, while also banking and supporting many of the most prominent venture funds based in Southern California. We have a nationwide venture banking practice and believe that Southern California is positioned well to continue to grow as a global tech hub.

Stifel Venture Banking is proud to be here for the long haul, supporting companies, investors, and other firms essential to making this ecosystem flourish. Many strong companies have been built here, and even more are on the way.

These are just a few of my takeaways. What are you seeing out there? I’d love to hear your thoughts.

Methodology

Data comes from PitchBook Data, Inc. Data has not been reviewed by PitchBook analysts.

Deal Date Range: January 1st, 2020 Through March 31, 2025 (Q1 2025). Includes projection for 2025 based on year-to-date data in Pitchbook through August 2025.

Deal Types: Seed, Early Stage VC, Later Stage VC

Deal Option: Full transaction search

Geography: Global dataset, with a filter applied to Southern California (Los Angeles, Orange County, San Diego, and Other) based on PitchBook location tagging based on Company headquarters.

Verticals: Companies categorized by PitchBook’s primary industry verticals and customized to fit into the following 4 verticals: Hard Tech (includes Climate Tech), Enterprise, Fintech, and Consumer.

Data Scope: Includes deal size, deal count, location (county-level), and industry vertical to enable aggregation and visualization of total VC dollars invested by county and sector. Data excludes the Life Sciences vertical.

Written by

Related Insights

Other articles designed to help you along your financial journey.