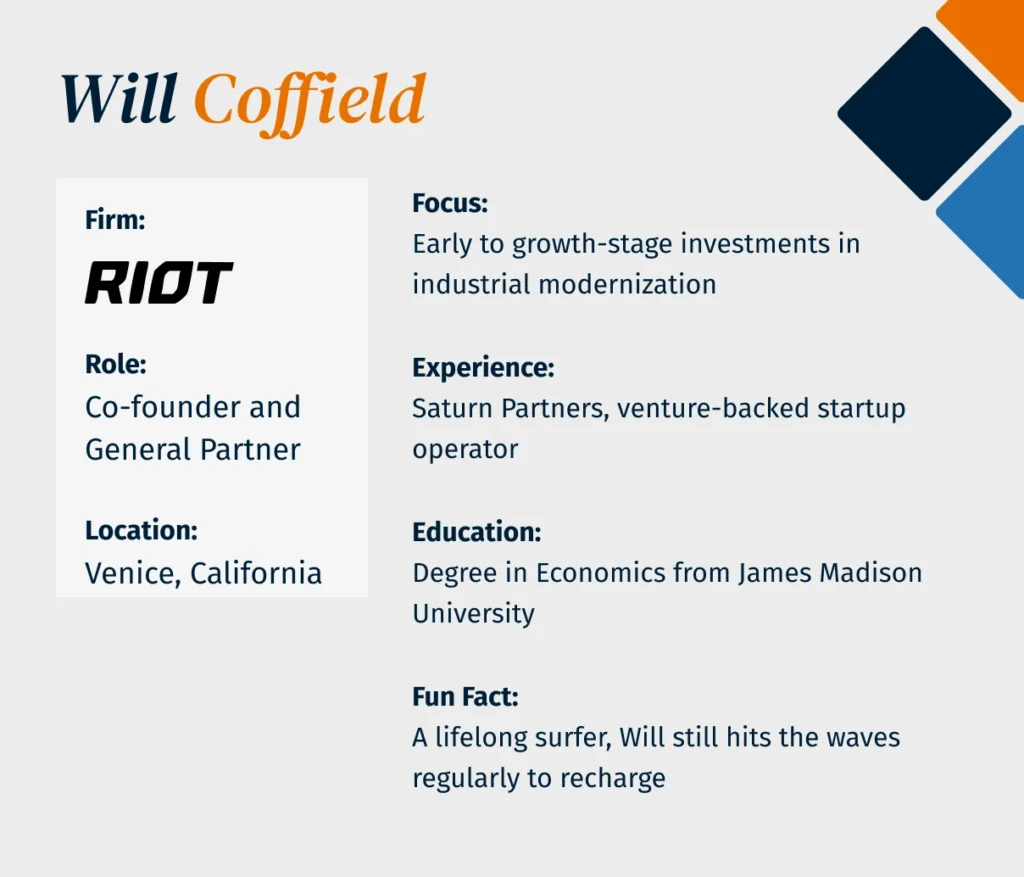

From Generalist to Deep Tech Specialist: A Conversation with Will Coffield, Co-founder of Riot Ventures

Venture Banking

Forge Series highlights the founders and experts driving deep tech innovation in Southern California. Hosted by Stifel Bank Managing Director Al Guerrero, these conversations explore industry trends, investment insights, and the challenges of building transformative companies. The series sets the stage for the annual Forge Conference, a gathering of top deep tech founders, investors, and executives.

Riot Ventures Co-founder Will Coffield reflects on his journey from Boston’s startup scene to building a thesis-driven VC firm focused on industrial modernization. By launching Riot Ventures in 2017, Will Coffield and his co-founder Steve Marcus placed an early bet on the future of full-stack technology transforming industrial sectors.

With over $1 billion in AUM and a footprint across the venture lifecycle, Riot is now a key player in the resurgence of hardware and embodied AI.

Stifel Bank Managing Director Al Guerrero sat down with Will to discuss his personal path into VC, Riot’s founding thesis, and what today’s hard tech founders must get right to succeed. This interview has been edited for length and clarity.

Q: Let’s start from the beginning. Where did you grow up, and what shaped your path into venture?

Will Coffield: I grew up in Alexandria, Virginia. My mother is a chef, and my dad is a defense attorney. Most of my childhood was spent getting in trouble with my mom and having my own in-house defense counsel help me navigate conflict.

I think that’s where I got a foundation for making strong arguments and working through complex conflict, which, as it turns out, is basically what a startup is all about.

I studied economics at James Madison University, which, to me, was sort of a confluence of a bunch of things I’ve always really liked—finance, history, geopolitics, psychology.

I became increasingly interested in technology and asking the question of ‘what sits perfectly at this intersection of technology and finance?’ and what I found was that venture capital is at that intersection.

Q: Walk us through your career path leading up to founding Riot Ventures.

Will Coffield: I moved to Boston with the idea that I would network my way into a chief of staff role at a great company, learn the inner workings of a startup, maybe dive into a specific operational role, and then use that to parlay into business school and then into venture.

I relentlessly networked within the Boston Startup ecosystem and started trying to meet with venture capital firms as a way to channel that energy toward identifying the right companies to focus my time on.

Saturn Partners hired me right out of undergrad. I helped build out the seed investing program and opened up their West Coast office. There, we were starting to see the venture asset class becoming increasingly populated with specialists, and the firms I was gravitating to were seed specialists or sector specialists. So, I fell back on my economic studies and looked at the flow of capital.

It did not take a sophisticated eye to very quickly see that a massive amount of capital was flowing into enterprise SaaS and consumer internet and that a total dearth was going towards industrial modernization. That initial idea ultimately led to starting Riot Ventures in 2017 with my partner, Steve Marcus.

Q: How did you and Steve Marcus come together to start Riot Ventures?

Will Coffield: We were both living in Boston at the time and were introduced by our two mentors. They set Steve and me up on a professional blind date. We were agitating for similar things at the time—me as a principal at a venture firm and Steve as a prolific angel investor. We clicked right away.

We ended up spending about two or three years getting to know each other, building our relationship, figuring out whether or not we had strong partnership dynamics, fleshing out the thesis that would become Riot Ventures, and then eventually launching the firm together.

Q. Tell us more about Riot Ventures, the differentiation, the thesis, and anything else we should know.

Will Coffield: The thesis for the firm has been the same since we started it in 2017. We believe we’re at the very early innings of a very dramatic transformation across critical industrial sectors. Those industries are going to be modernized by entrepreneurs wielding very powerful advanced technologies that are often full-stack in nature. And we take on the most substantial—often physical—challenges facing customers in aerospace and defense, logistics, energy, construction, manufacturing, etc.

We started with a small $10 million fund that was exclusively focused on pre-seed and seed. Today, we have over $1 billion in AUM. We are doing everything from writing half a million dollar checks into early-stage businesses all the way up to writing $100 million checks into pre-IPO companies.

Our core focus is on institutional pre-seed and seed with regard to the way we initiate a relationship with early-stage companies. We’re not playing a coverage game. We’re very thesis-driven. We know what we’re looking for as it pertains to business model dynamics and certain industries of interest. When we find what we’re looking for, we’re all in, and we partner very closely with those founders to help them build iconic businesses.

Q: How are you thinking about where the hard tech market is right now?

Will Coffield: I think there are a few subsectors that have gotten overheated—like defense. But ultimately, we’re enthusiastic about the fact that everybody has recognized this style of investing and wants to join us.

Building a generation of companies the size of SpaceX, Tesla, and Nvidia will require the industry at large to participate. This isn’t a small opportunity that can only support a handful of venture capital firms.

It certainly benefits us substantially to have identified this opportunity early on, but if we had stayed small, it would have been because we were wrong about the magnitude of the opportunity.

In the last five years in particular, the rest of the asset class has recognized how substantial the value creation opportunity is across these legacy industrial sectors and how broad the applicability of embodied AI is going to be as artificial intelligence makes its way off the screen and into the physical world.

Q: How are you thinking about timing and capital flow across sectors like defense and energy? You mentioned defense being at a boiling point.

Will Coffield: This is a gross overgeneralization, but I would say, short defense, long energy.

We’ve deployed a massive amount of our capital into defense and are very excited about the investments we’ve made in that space. We view it as a multi-generational modernization of the U.S. Defense industrial base. That said, we see energy today where defense was five years ago.

Investing in defense five years ago was a very good opportunity. Investing in defense now, with so much heat around it, might be more marginal. We’re still monitoring the sector closely, but our instinct is telling us to spend more time in energy.

Q: What qualities do you look for in founders building in hard tech or deep tech?

Will Coffield: What we are looking for in the hard tech and deep tech ecosystem is somebody who can craft and deliver an exciting and approachable narrative.

I still want to hear a pitch like I’m a third grader—assume I know nothing, and tell me why this matters. Then, take me into the intricacies we understand well. I want to see that you can pitch to me like I’m a neophyte and still get me excited, because that’s what it takes to galvanize downstream capital, talent, policy stakeholders, and customers.

I want to see that you’re a world-class storyteller who knows how to meet an audience where they are and bring them down the learning curve quickly. At the end of the day, these big, bold visions require rallying an interdisciplinary disparate group of stakeholders, all eventually converging to row in the same direction.

I want to feel confident that you could sit across from a government bureaucrat and communicate your vision in a way that resonates and inspires support. Ultimately, what we’re screening for is a kind of evangelistic, even messianic, storytelling ability.

Q: We’ve covered a lot on thesis and strategy—let’s end with something a little lighter. What helps you recharge outside of work?

Will Coffield: I love surfing. I love cooking and entertaining friends. My mother taught me how to cook. So, I’m a very solid cook, a mediocre surfer, and a terrible dog trainer.

Written by

Related Insights

Other articles designed to help you along your financial journey.