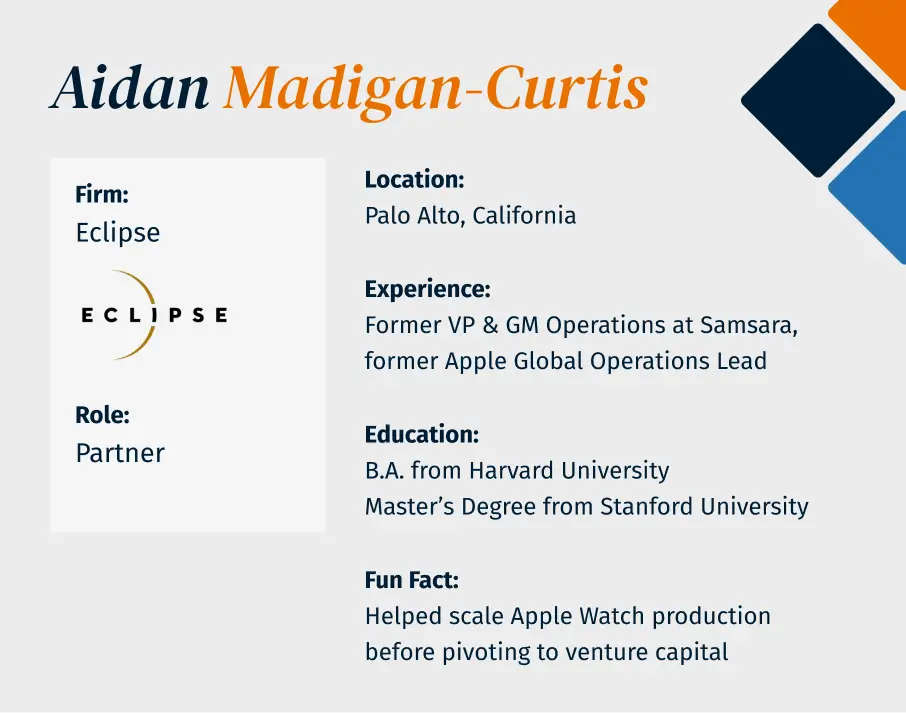

Scaling Industrial Tech: A Conversation with Aidan Madigan-Curtis of Eclipse

Venture Banking

Forge Series highlights the founders and experts driving deep tech innovation. Hosted by Stifel Bank’s Venture Banking team, these conversations explore industry trends, investment insights, and the challenges of building transformative companies. The series sets the stage for the annual Forge Conference, a gathering of top deep tech founders, investors, and executives.

Aidan Madigan-Curtis, Partner at Eclipse, breaks down how Samsara hit $1B in ARR through disciplined execution, smart product sequencing, and a mid-market focus—and shares lessons for founders in industrial tech.

Inside Samsara’s Blueprint for Industrial-Grade Scale

Aidan Madigan-Curtis joined Samsara in 2016, when the company was pre-product and pre-revenue. Today, Samsara is a public company valued in the tens of billions—one of the rare few to achieve $1 billion in Annual Recurring Revenue (ARR) in record time.

In her talk for Stifel Bank’s Forge Series, Madigan-Curtis, now a Partner at Eclipse, walked through the DNA of that growth story. Not just what Samsara built, but how they built it and why their execution model offers a roadmap for founders in physical and industrial sectors.

This interview has been edited for length and clarity.

Q. What was the product breakthrough that unlocked Samsara’s growth?

A. Samsara’s original ambition was to bring cloud-connected sensor technology and real-time data to physical operations and logistics—essentially, to digitize “the real world of operations.”

We started by building simple, cloud-connected sensors and trying to find real customers who would adopt them and tell us what to build next.

Our first prototype was a gateway-connected temperature sensor. We initially deployed it in industrial environments, offering real-time alerts and analytics for temperature monitoring. We also built similar sensors, like water-tank level monitors that we piloted with the City of San Jose Water.

Cowgirl Creamery, a cheese maker, became one of our early design partners. In a fascinating twist—the kind you only learn by listening closely to early customers—they didn’t deploy the sensors in refrigerators but in their delivery trucks. Their biggest challenge was maintaining

consistent cold-chain temperature during transport, knowing exactly where their trucks were, and how they were performing.

Consistent feedback from customers like Cowgirl Creamery helped us realize there was a real need and an exciting market—not just monitoring temperature, but connecting sensor data, vehicle tracking (GPS), and diagnostics, all tied to cloud analytics.

Q. How did Samsara sell into an existing market instead of creating a new one?

A. The Samsara founders had learned many lessons from their previous company, Meraki. One of the most important was to find an existing budget to sell into, rather than trying to convince enterprise or operational customers to create a new one.

So, in the early days, we made sure to sell into existing markets instead of taking the approach of “We built a great product, now go figure out who wants to buy it.” From the start, Samsara focused on product and platform development where budgets already existed—and designed a better mousetrap.

In our case, fleet managers were already spending money on telematics. But the incumbent products were ossified and built on outdated tech stacks.

Additionally, we made Samsara’s product easy to try before buying. We offered plug-and-play free trials so customers could see how quickly and easily the product could be installed—critical, since telematics installs often required taking utilization-sensitive vehicles off the road for some time. We designed the product so customers could get up and running without pain, and see firsthand how superior Samsara’s experience was compared to incumbents.

Q. What role did the dash cam play in Samsara’s success?

A. The dash cam was extremely accretive as a second high-growth product. With telematics, you could see harsh braking or location, but you couldn’t see what actually happened. Cameras provided rich additional data and the opportunity for (a) driver exoneration and (b) preventative, proactive coaching. It was a huge hit. Because we were selling to the same buyer, we could go back to existing customers and offer them a new layer of value. The two products together created more value than either one on its own.

Q. Why did Samsara focus on mid-market customers instead of enterprise?

A. Over time, we worked with customers of all sizes. But early on, we built a really strong mid-market sales motion.

Enterprise sales cycles can be very long and if your business depends only on these customers, you risk “feast-or-famine” quarters, which isn’t great for predictability. In the early days, mid-sized customers saw incredible ROI with Samsara’s product, were easier to work with, and had fewer complexities compared to large enterprises, which understandably require more integrations and customizations.

Q. What did execution look like on the inside?

A. We were evolving rapidly. Most importantly, the founders consistently upheld a culture of meritocracy while adapting the organization to the next phase of scale. We were always thinking two to five years ahead—and planning for our product roadmap and associated talent accordingly.

Q. What can founders building in physical industries learn from Samsara’s approach? A. Don’t try to create a market from scratch if you can build into existing spend. Make the product so simple and effective that it removes all friction from the buying process. Sequence your roadmap to amplify value, not complexity.

Start with fast-moving customers who can give you clean feedback cycles and short sales motions. And don’t be afraid to evolve your team as you grow. That discipline was core to how we scaled and why we reached $1B in ARR so quickly without sacrificing operational rigor. You rarely see execution like this. I have tremendous respect for Samsara’s founding team and my former colleagues who are still at the helm.

Related Insights

Other articles designed to help you along your financial journey.