Innovation Community

Venture Banking

Learn how our entrepreneurial culture and long-term vision make us the right banking partner for you.

Why do founders and finance teams choose Stifel Bank?

Founding teams need more than an account for their cash. They deserve a partner who understands the nuances of building a company.

Here’s what Stifel Bank delivers.

Trusted relationships with real expertise

Get a dedicated relationship team with relevant stage and sector experience.

Safety and security of funds

ICS® offers you access to millions of dollars in aggregate FDIC protection per insurable capacity, across network banks.¹

Account opening in a matter of days

Aim to complete account openings within

2-3 business days with a digital-forward experience built for speed and ease.

Modern treasury platform

Manage operating cash with digital ease. Stifel Bank’s treasury tools are built for visibility, control, and scale.

Flexible lending solutions

Access non-dilutive credit facilities for seed stage through IPO and beyond, structured to grow with your business.

Value beyond banking

Unlock tailored guidance and introductions to the investors, customers, and talent who can help you scale.

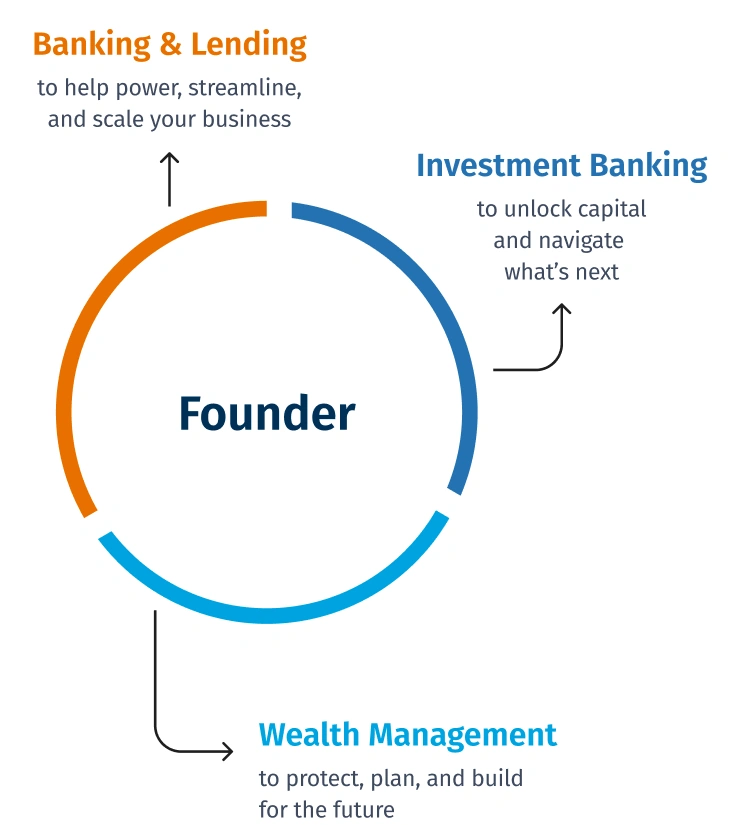

One platform, built to scale with you.

From company formation to IPO and beyond, the Stifel Bank team evolves alongside you, offering the right solutions when you need them most.

Seed Stage

Fast onboarding, digital treasury.

Founder-first guidance and digital tools to help you get started with confidence.

Series A-B

Solutions for growth.

Cash management, comprehensive lending solutions from venture debt to working capital, and insights from Stifel’s Investment Bank and research platform.

Series C+

Institutional tools for scale.

ICS® offers you access to multi-millions in aggregate FDIC protection per insurable capacity across network banks. ICS is a smart, secure, and convenient way to place large cash deposits directly through Stifel Bank.¹

Exit & Beyond

Personal planning for liquidity and legacy.

Comprehensive wealth management for founders, including exit advisory, long-term planning, and family office support.

Venture Banking Sectors

Delivering tailored solutions to fuel innovation and growth across a broad spectrum of industries.

We're proud to be a part of your journey.

Get to know our clients, collaborators, and solutions.

Innovation Insights

Regularly updated library of insights to help your business grow.

Meet your Venture Banking team.

Our team is known for our superior level of service, passion, and entrepreneurial approach to banking. We’re committed to providing you with tailored solutions and sound business perspectives for generations to come.

More than 135 years old and still thinking like a startup.

At Stifel, we have the knowledge, experience, and resources to help you address even the most complex needs. Stifel’s innovation community connects you with the full resources of our 9,000-person global financial firm.

- Investment Banking

- Private Banking

- Wealth Management and Financial Planning with a Stifel Financial Advisor

- Economic Insights, Thought Leadership, and Research

Stifel’s long-term leadership drives the entrepreneurial culture of our firm, empowering associates to deliver for our clients through collaboration, innovation, and ingenuity. These collective efforts are demonstrated by the growth of our firm, our financial strength, and our nimble approach to opportunity. It’s quite simple. We believe that when we put you – our client – first, we put you in the best position to achieve success, however you may define it. Let’s connect to see how Stifel’s nimble, innovative approach to banking can help you and your company.

Build the future of innovation through Stifel Venture Banking.

Discover opportunities to collaborate with cutting-edge startups and visionary founders, build strong relationships, and shape the future of innovation.

Career Opportunities

Contact Us

Need help? We’re here for you. Fill out the form below, and we’ll get back to you as soon as we can.

¹To view the list of banks in the IntraFi network, visit www.intrafi.com/network-banks. Certain conditions must be satisfied for “pass-through” FDIC deposit insurance coverage to apply. Deposit placement through an IntraFi service is subject to the terms, conditions, and disclosures in applicable agreements. Deposits that are placed through an IntraFi service at FDIC-insured banks in IntraFi’s network are eligible for FDIC deposit insurance coverage at the network banks. The depositor may exclude banks from eligibility to receive its funds. To meet conditions for pass-through FDIC deposit insurance, deposit accounts at FDIC-insured banks in IntraFi’s network that hold deposits placed using an IntraFi service are titled, and deposit account records are maintained, in accordance with FDIC regulations for pass-through coverage. Although deposits are placed in increments that do not exceed the FDIC standard maximum deposit insurance amount (“SMDIA”) at any one bank, a depositor’s balances at the institution that places deposits may exceed the SMDIA before settlement for deposits or after settlement for withdrawals. The depositor must make any necessary arrangements to protect such balances consistent with applicable law and must determine whether placement through an IntraFi service satisfies any restrictions on its deposits. IntraFi and ICS are registered service marks of IntraFi LLC. IntraFi is not an affiliate of Stifel Bank.