Stifel Bank + Kauffman Fellows: Dedicated Banking Support for the KF Network

Your Dedicated Stifel Bank Contact

Working hard to support you every step of the way

“I’ve spent over 17 years in venture banking, partnering with founders and fund managers across every stage—from first check to IPO, and from emerging managers to established platforms. At Stifel Bank, we bring deep experience across sectors like AI, Frontier, Consumer, Health, FinTech, Enterprise, and Cyber. I’m proud to serve as your point of contact and excited to continue supporting the Kauffman community through meaningful relationships and shared growth.

Feel free to reach out anytime!”

Ann Kim

Managing Director, Venture Banking, Stifel Bank

Kauffman Fellow, Class 24, Co-Chair of the San Francisco Chapter

Comprehensive Banking for Funds and Startups

Tailored financial solutions and support – built to grow with you.

Banking for Emerging and Established VC Funds

Whether you’re an emerging manager launching your first fund or a seasoned GP expanding your platform, we’re here to support your growth—without the barriers. That means:

- No minimum AUM requirements, no treasury or wire fees, and a relationship-first approach that puts your success front and center

- Tailored credit solutions

-

Fund capital lines of credit

-

Management company lines of credit

-

Personalized offerings like GP lending and NAV lines

-

- High-touch service, access to a powerful network, and industry insights

- Fund Administration Integration with all the top market participants including: Carta, JNPR, Standish, Gen II; and many more

- Access to exclusive, highly curated, invite only events

Your Trusted Banking Partner

Banking For Your Portfolio Companies

A Strategic Partner for Companies of All Stages from Seed through IPO

Focused on seed stage through late stage, our Venture Bankers deliver valuable banking resources and capabilities to clients, focusing on technology and healthcare sectors. Committed to supporting the innovation community, our entrepreneurial culture and long-term vision make Stifel the right banking partner for Founders and Companies. We offer a dedicated relationship manager, speed and efficiency in the account opening process (our goal is to complete account openings within 2-3 business days), and access to Stifel Bank’s debt financing solutions, including venture debt.

Learn more about our Stifel Startup Solution to support your growing business.

Stifel Startup Solution

Premium offerings for Kauffman Fellows.

Deposit placement through an IntraFi service is subject to the terms, conditions, and disclosures in applicable agreements. Deposits that are placed through an IntraFi service at FDIC-insured banks in IntraFi’s network are eligible for FDIC deposit insurance coverage at the network banks. The depositor may exclude banks from eligibility to receive its funds. To meet conditions for pass-through FDIC deposit insurance, deposit accounts at FDIC-insured banks in IntraFi’s network that hold deposits placed using an IntraFi service are titled, and deposit account records are maintained, in accordance with FDIC regulations for pass-through coverage. Although deposits are placed in increments that do not exceed the FDIC standard maximum deposit insurance amount (“SMDIA”) at any one bank, a depositor’s balances at the institution that places deposits may exceed the SMDIA before settlement for deposits or after settlement for withdrawals. The depositor must make any necessary arrangements to protect such balances consistent with applicable law and must determine whether placement through an IntraFi service satisfies any restrictions on its deposits. IntraFi and ICS are registered trademarks of IntraFi LLC. IntraFi is not an affiliate of Stifel Bank.

1Minimum initial deposit of $250,000. No minimum balance to earn APY. Interest rate is variable and subject to change at any time. Fees may reduce earnings. After the 12-month promotional period, the interest rate will adjust to Stifel Bank’s standard ICS rate tiers. To view the list of banks in the IntraFi network, visit www.stifel.com/Stifel-ICS-Banks-List.

2Services are free for initial 12-month period. After free 12-month period, all banking services are subject to regular fees. Talk with your banker about account fees.

3Ramp is not an affiliate of Stifel Bank.

4Bonus will be paid by Ramp via Amazon eGift Card after your first balance payment of $1,000 within 60 days of account opening.

5Sequoia One is not an affiliate of Stifel Bank.

6Reference the Stifel Venture Banking Preferred Partnership Rewards Agreement for full terms and conditions

Get to know Stifel

$32 Billion

in Bank assets

7th largest Wealth Management platform

by number of financial advisors with more than 2,300 financial advisors in 400 Branches across U.S.

Over $500 billion

in client assets under management

#1 in Equity Deals

Under $1 Billion Market Cap7

#3 in all Managed Venture Capital-Backed IPOs

A standout in venture-backed IPOs8

Growth via M&A

with 36 transactions in the past 20 years, including Thomas Weisel Partners, KBW, and Barclays Wealth & Investment Management, Americas

7Dealogic. Rank-eligible SEC registered IPOs and Follow-on offerings since 2012 as of 2/29/24.

8Dealogic. Venture-backed IPOs ranking since 2005 as of 2/29/24.

*Company data as of 12/31/2024 unless otherwise noted. Learn more at www.Stifel.com/Investor-Relations.

More than 135 years old and still thinking like a startup.

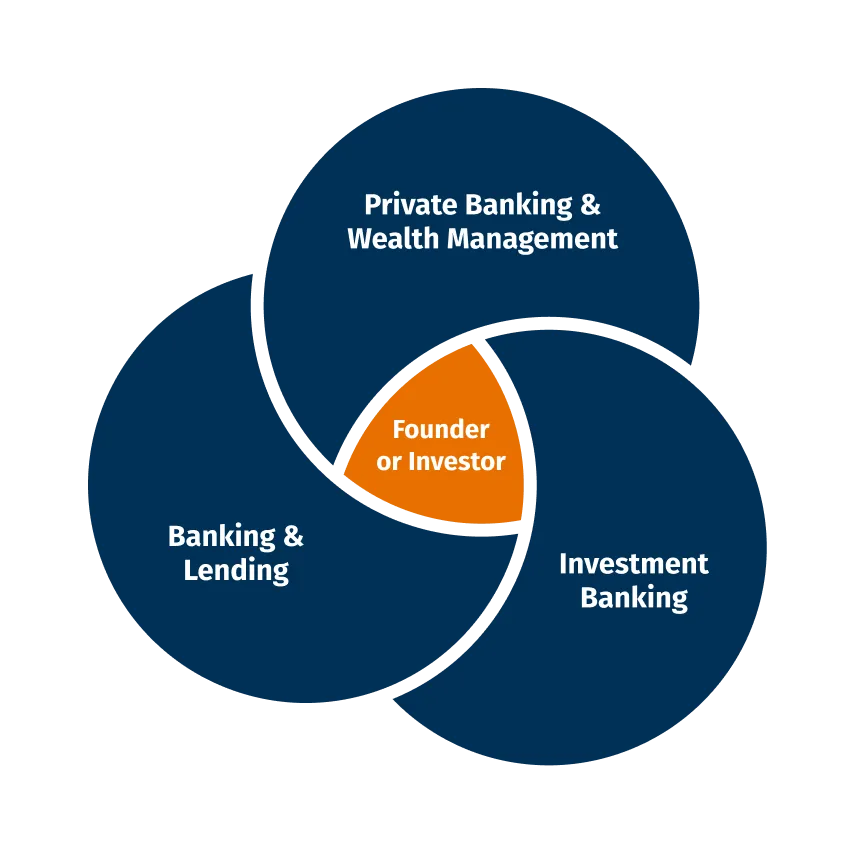

At Stifel, we have the knowledge, experience, and resources to help you address even the most complex needs. Stifel’s innovation community connects you with the full resources of our 9,000-person global financial firm.

- Investment Banking

- Private Banking

- Wealth Management and Financial Planning with a Stifel Financial Advisor

- Economic Insights, Thought Leadership, and Research

Stifel’s long-term leadership drives the entrepreneurial culture of our firm, empowering associates to deliver for our clients through collaboration, innovation, and ingenuity. These collective efforts are demonstrated by the growth of our firm, our financial strength, and our nimble approach to opportunity. It’s quite simple. We believe that when we put you – our client – first, we put you in the best position to achieve success, however you may define it. Let’s connect to see how Stifel’s nimble, innovative approach to banking can help you and your company.

Related Insights

Your Dedicated Stifel Bank Contact

Ann Kim

Kauffman Fellow, Class 24

Co-Chair of the San Francisco Chapter